does betterment provide tax documents

Just lump them together under a country. They are not intended to provide comprehensive tax advice or.

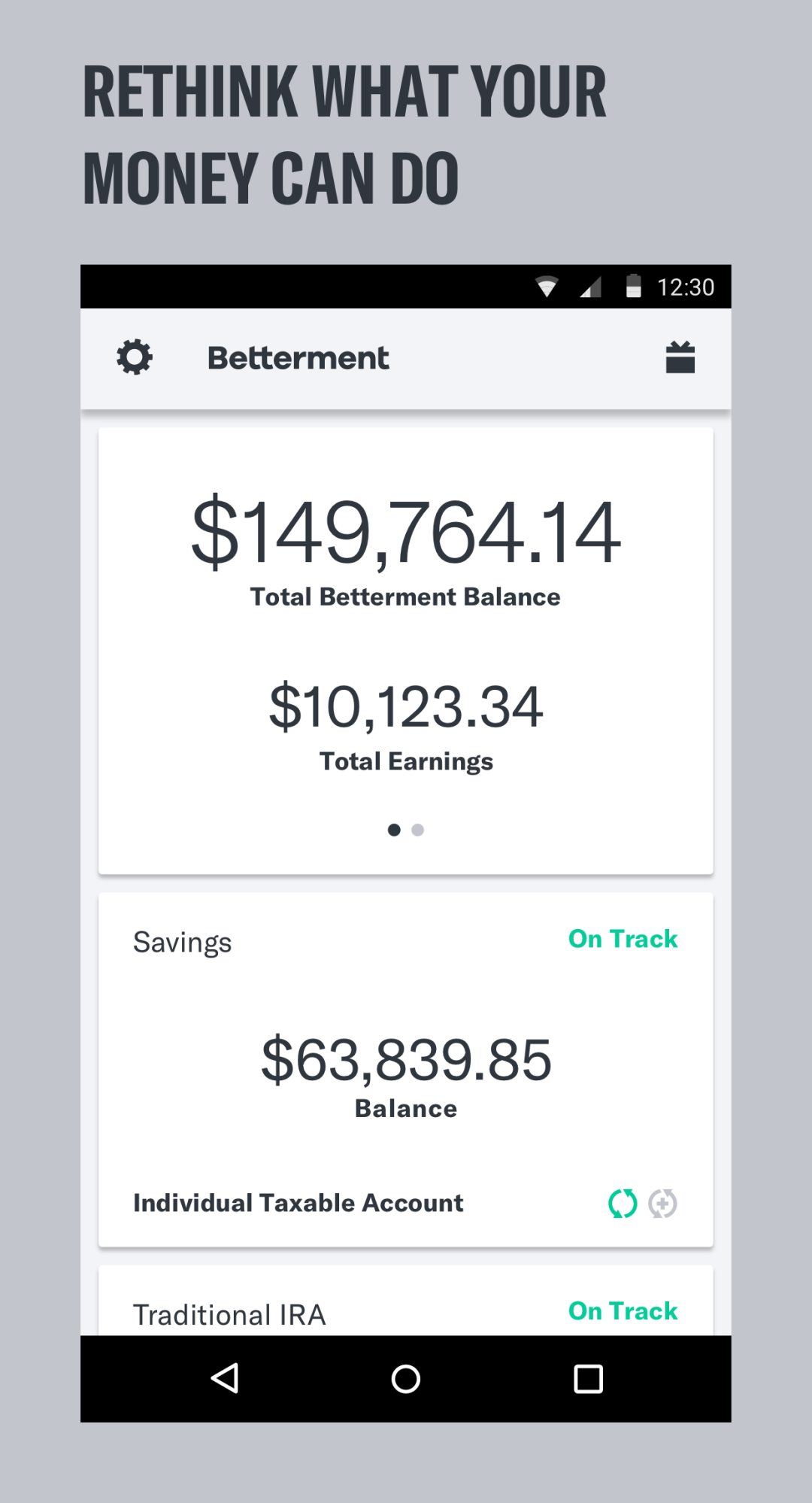

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Betterment Tax Forms.

. Betterment has calculated this for you based on your state of residence listed within your account. Only dividends and realized gains will have tax due. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust.

Betterment will send you. Betterment Taxes Summary. Betterment Digital provides automated portfolio management and charges 025 annually.

31 is the deadline for. Asset location and tax loss harvesting. On top of that Betterment supports a much wider range of account types.

Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. If you sign up for a Betterment account and think that you never need to. A newer and more advanced benefit that Betterment offers is tax optimization.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. Tax-loss harvesting has been shown to boost after.

Simply head to the Documents section of your account and then click the Tax Forms. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. The foreign taxes populate with the download but you have to manually enter the foreign source income total.

Betterment is really good at getting you the tax documentation you need on time but they cant pay your taxes for you. This primarily takes two forms for Betterment. On the other hand Fidelity gives.

Betterment increases after-tax returns by a combination of tax-advantaged strategies. Betterment also offers tax-loss harvesting while Fidelity doesnt. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains.

We may also provide you with a Supplemental Tax Form that calculates key tax information for. Betterment is a clear leader among robo-advisors offering two service options. Betterment keeps track for you and provides all the tax documents you need.

Tax Smart Investing With Betterment

Betterment Acquires Wealthsimple S U S Investment Advisory Book Of Business

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

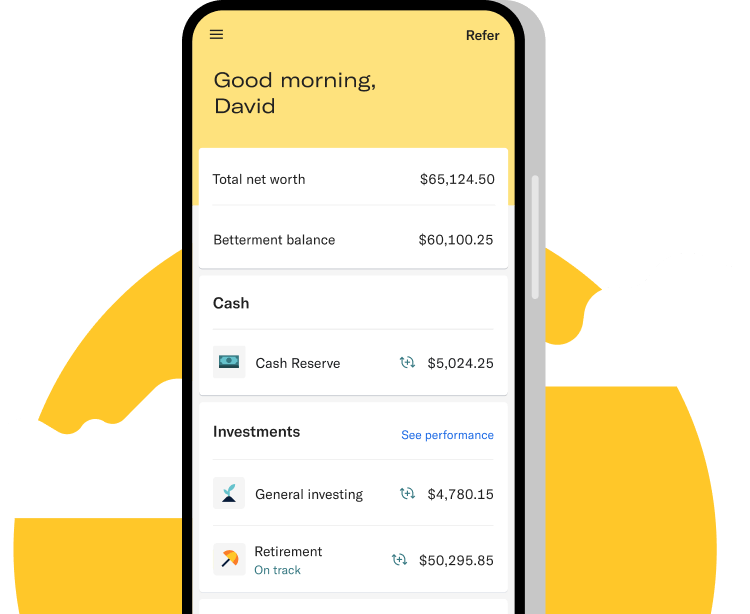

Betterment Insider Investing Scoop Investing Robo Advisors Good Things

Your 2015 Tax Season Calendar Tax Season Season Calendar Tax Help

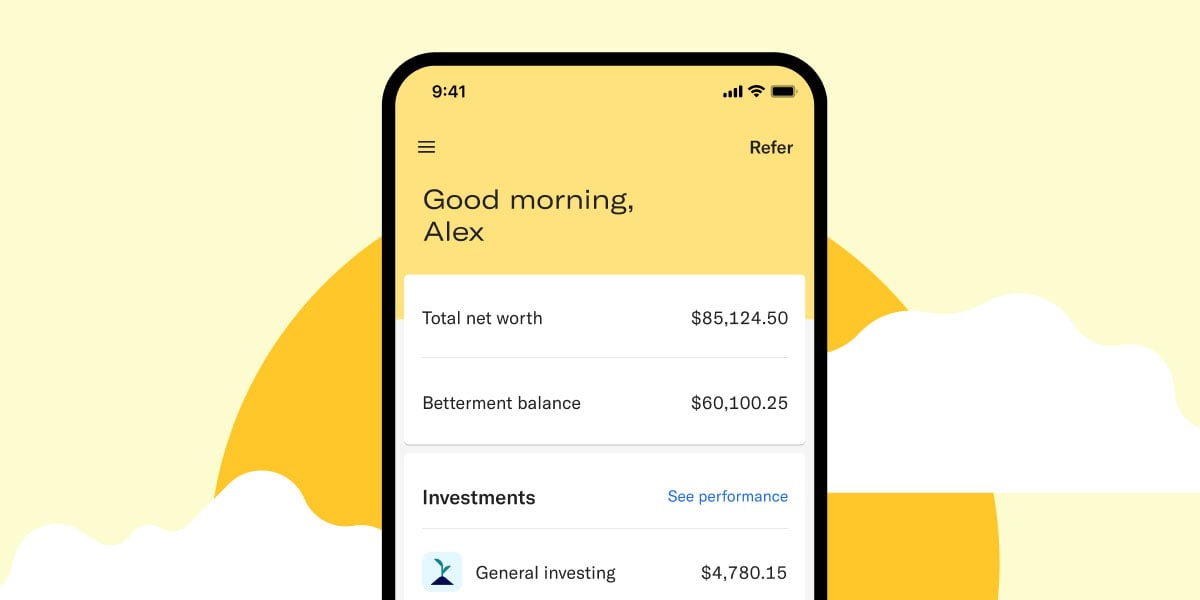

Betterment Mobile App Investing On The Go

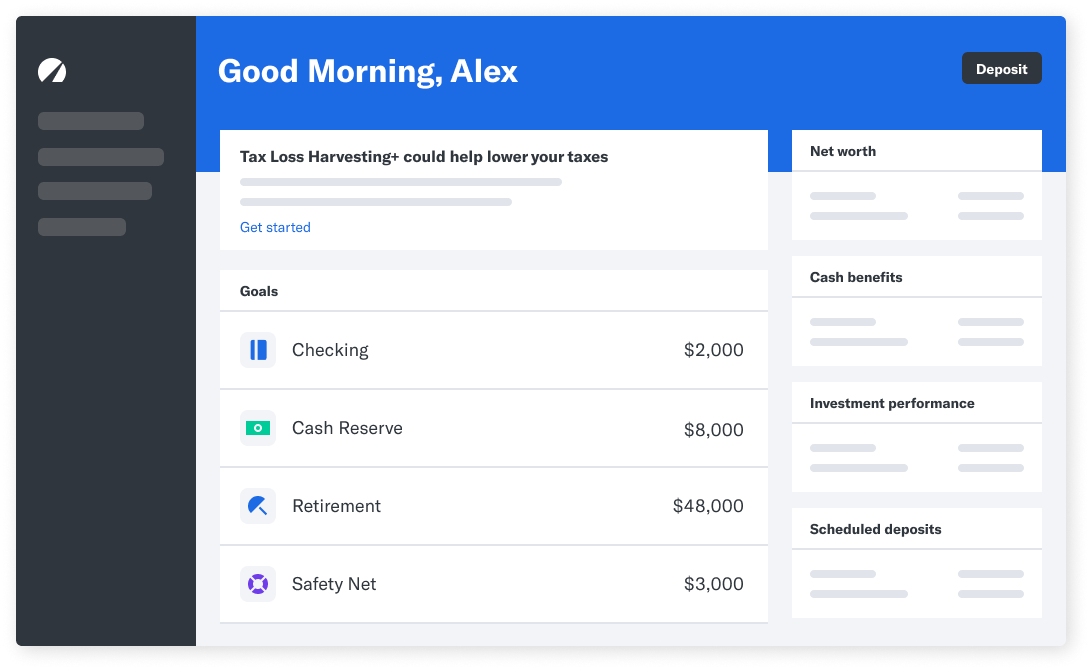

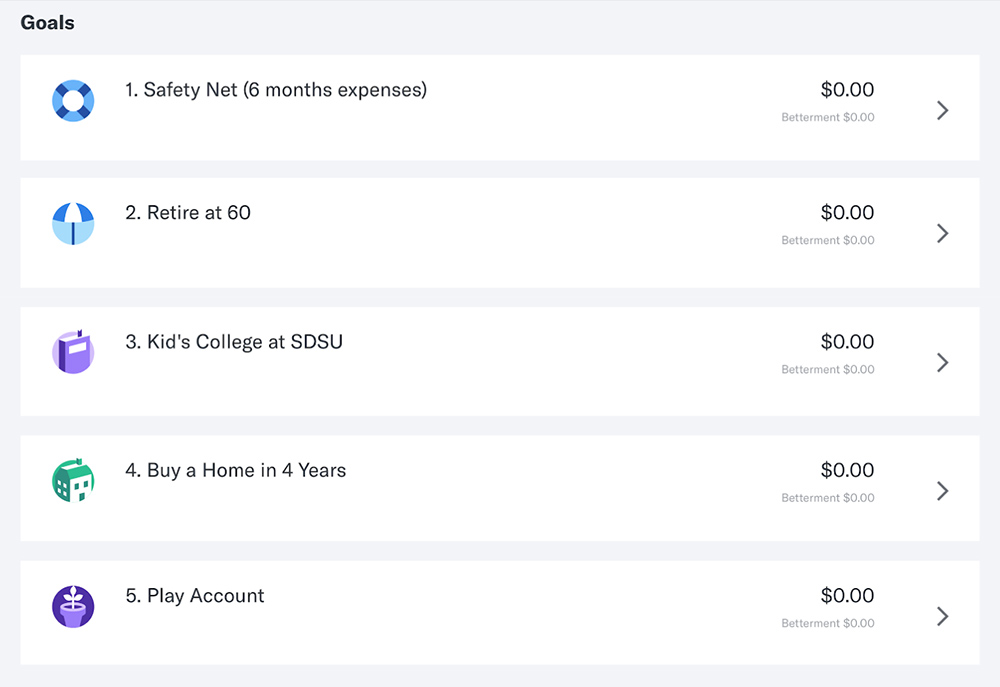

How To Set Up Your Investments Correctly At Betterment

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Finance Investing Investing Money Investing

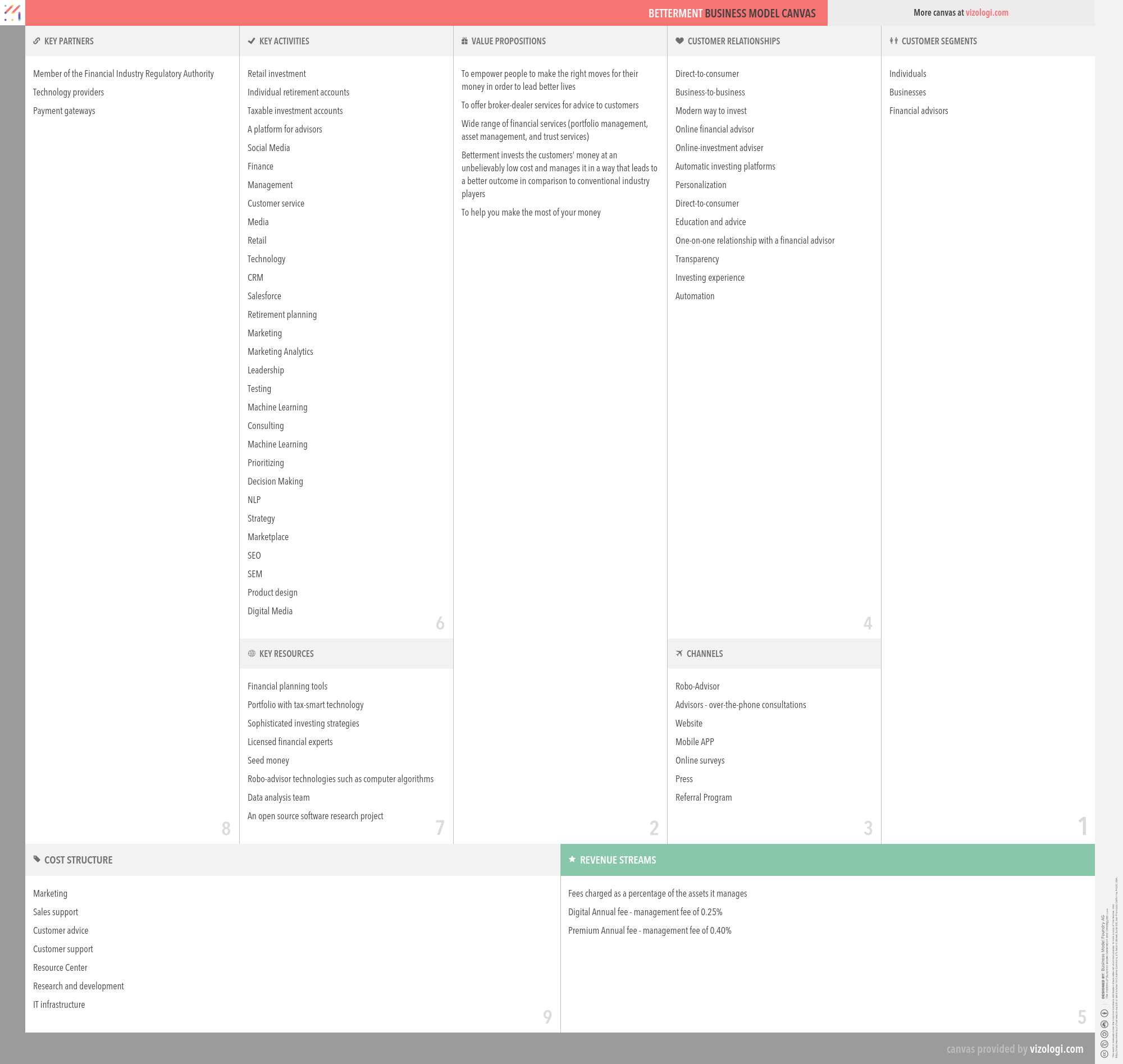

What Is Betterment S Business Model Betterment Business Model Canvas Explained Vizologi

Best Robo Advisors Mutuals Funds Fund Stock Investing For Dummies

Retirement Advice Retirement Calculator Investing For Retirement

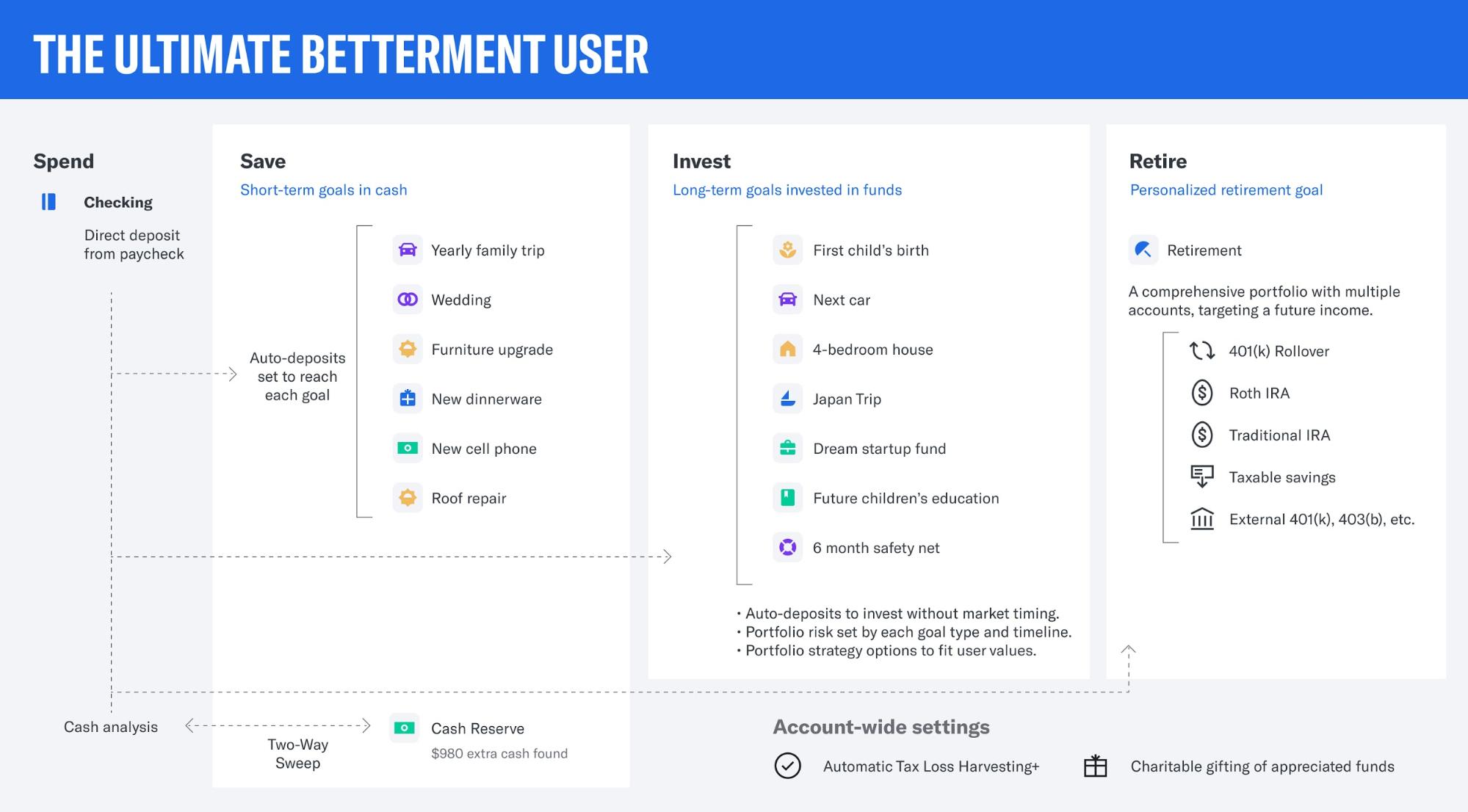

What The Ultimate Betterment User Looks Like

Betterment Checking And Betterment Cash Reserve Review Cash Management Certificate Of Deposit Best Ira Accounts

What The Ultimate Betterment User Looks Like

Services Provided By A Title Company Title Insurance Title Property Tax

Skills For Acting Resume Luxury 5 Acting Resume Templates Besttemplatess123 Acting Resume Acting Resume Template Job Resume Examples

Betterment Taxes Explained 2022 How Are Investment Taxes Handled